Let’s take a brief moment to discuss one of the more important aspects of an investment portfolio: asset allocation. Put simply, it’s the percentage of an investor’s portfolio that they decide to allocate to different asset classes, such as cash, bonds, precious metals, real estate, or stocks. Generally, personal finance literature boils it all down to the mix between bonds and stocks as a simplification. Additionally, the mix between bonds and stocks is usually suggested to be a function of age, as to reflect the recommended level of risk tolerance for any investor as they wind down their income earning years and get closer to retirement age.

My personal take on asset allocation is fairly aggressive, and is aimed at enterprising, studied investors that understand risk and utility, are long-term oriented, and willing to risk a bit of short-term volatility for a good shot at great long-term gains. Like other asset allocation schemes, I believe that the percentage invested in stocks should be 100% at the beginning of a person’s income earning years, as to maximize time in the most productive segment of the market in the form of equities. The percentage of one’s portfolio allocated to stocks should then decay slowly, and ramp down at an accelerated pace as retirement nears. They key is that the allocation ratio should not be linear because, honestly, life is not linear!

With that, I present an elegant, sophisticated formula for determining your ideal asset allocation. The percent of a portfolio to allocate to bonds is

where is your age and is a numeric value representing your tolerance for risk, and has a recommended starting value of 2; it can be adjusted up or down according to your personal level of risk tolerance.

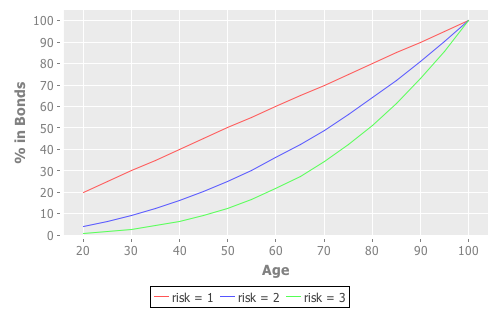

Of course, by now you should’ve figured out that we were being hyperbolic about the claims for sophistication, but that doesn’t mean you should take this simple formula lightly. Here’s a visual depiction of the asset allocation, from ages 20 to 100, that would result from employing such a formula:

The key variable in this function is the risk exponent that you can use to adjust to meet your personal needs. At the baseline risk level of 1, your asset allocation becomes identical to the conventional asset allocation advice of simply using your age as the percent of bonds to allocate in your portfolio. As the desired risk exposure increases, your portfolio spends more of its early years invested in stocks as to maximize the exposure to market growth. At a certain point, the percentage of bonds allocated should accelerate as you head into retirement. Note that if you are completely risk-averse, you can opt to take on a risk level of 0, which would suggest you always allocate 100% of your portfolio to bonds, irrespective of age.

With the recommended risk level of 2, you can see that our sophisticated allocation formula recommends the same percentage of bonds as the modern conventional allocation scheme of using “subtract 20 from your age” right around the age of 70, which is the general retirement finish line for most individuals. The percentage allocated to bonds then accelerates as the need for stable, fixed income increases along with the need for principal preservation.

For example, by this scheme a 20 year old should allocate 4% of her portfolio to bonds, and the rest to stocks. At 30 years old, she should allocate 9% of her portfolio to bonds. The portion of bonds held remains less than half until the ripe age of retirement at around 70, as to maximize the expected returns during the period of time in which the most money will likely be contributed to one’s portfolio as earning potential peaks in the 50s and 60s.

With this allocation formula in hand, you can then come up with your own allocation plan as a function of your risk tolerance, and follow typical asset allocation practices by periodically rebalancing your portfolio (perhaps every half, one, or two years) by selling the outsized asset class in your portfolio and replacing with the other asset class.

Keep in mind that it is not critical for your allocation to follow the function exactly, but you should instead be rigorous in sticking to a consistent, periodic plan for rebalancing as to “fit” the function to approximate the plan for your tolerance for risk as closely as possible.

Comments